17 Jun 2025

Rental Market: M&A activity accelerates across Europe

Rental as a resilient and scalable solution

In an economy with uncertainty, capital preservation, and a growing appetite for flexibility, the European rental market has emerged as a resilient and fast-growing sector. Driven by small and mid-sized enterprises (SMEs) seeking to reduce capital expenditures and increase operational agility, equipment rental has transitioned from a cyclical option to a strategic business choice. This shift is further fuelled by increasing ESG and sustainability priorities, as rental models enable more efficient resource use, promote circularity, and reduce environmental impact.

In 2024, the global equipment rental market reached $153.7 billion, with Europe accounting for $37 billion and the Netherlands contributing $6.3 billion. Notably, the Dutch rental market is expected to grow at a 5.5% CAGR through 2029, outperforming the European average of 5.2% and closely aligning with global growth expectations.

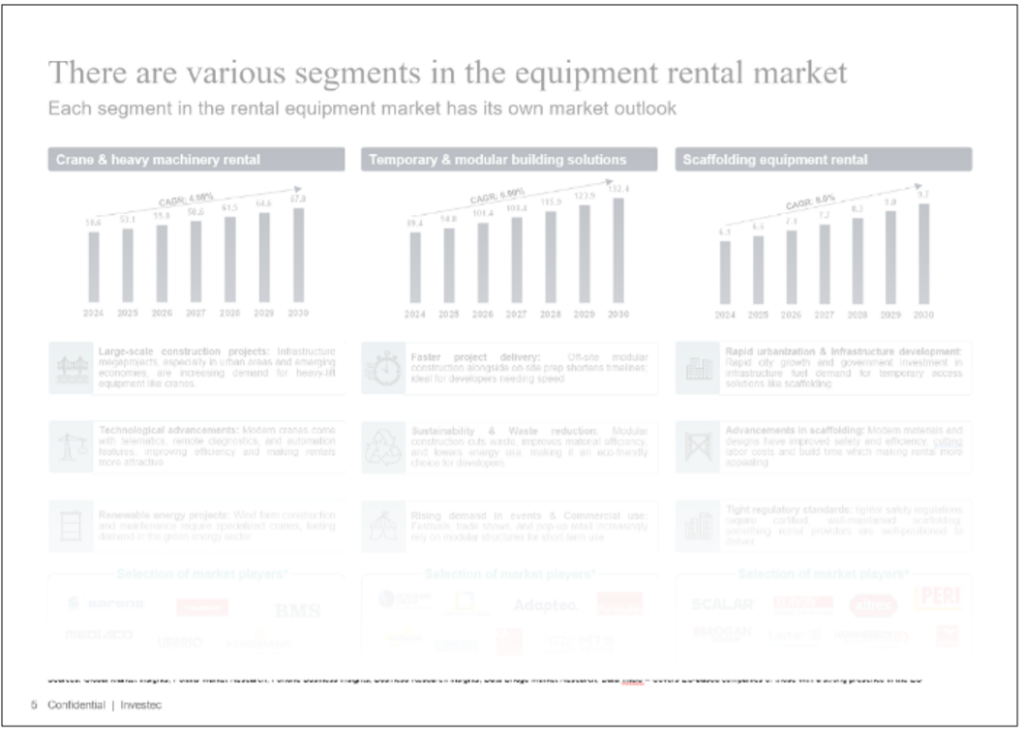

Resilient growth across key rental verticals

The equipment rental sector spans a wide range of segments, each with unique drivers and robust long-term outlooks:

- Scaffolding Equipment Rental (CAGR: 8.0%): Fuelled by stricter safety regulations, rapid urbanization and construction

- Temporary & Modular Buildings (CAGR: 6.9%): A key enabler for sustainable construction, fast project turnaround, and events infrastructure

- Cranes & Heavy Machinery (CAGR: 4.98%): Supported by infrastructure megaprojects and renewable energy investments

- HVAC & Energy Solutions (CAGR: 4.3%): Essential for healthcare, emergency events, and large-scale construction

- AV & IT Equipment Rental: (6.3%) CAGR: Increasingly driven by hybrid work, online education, and rapid tech innovation

M&A: a consolidating and competitive landscape

After a slight dip in 2023, M&A activity in the rental sector rebounded in 2024, signalling increased confidence in the market. Strategic buyers continue to dominate, accounting for over 50% of all transactions, with strong interest in regional champions and niche rental categories.

According to Investec’s proprietary analysis of ~500 European rental transactions between 2020 and 2024:

- The UK led with 89 deals, followed by France (62), DACH (57), the Nordics (43), and Benelux with 27, home to key consolidators such as Boels.

- The sector sees a relatively high proportion of domestic transactions, particularly in France where 87% of deals remain within national borders.

Meanwhile, large platforms like Ashtead, Kiloutou, and Boels are acquiring in adjacent segments such as mobile lighting, modular buildings, and HVAC, highlighting a growing preference for product/equipment diversification and full-service offerings.

Valuation multiples for listed rental players have recovered in 2025, with average EV/EBITDA rising from 6.0x in 2024 to 6.4x, and the median multiple hitting 7.4x.

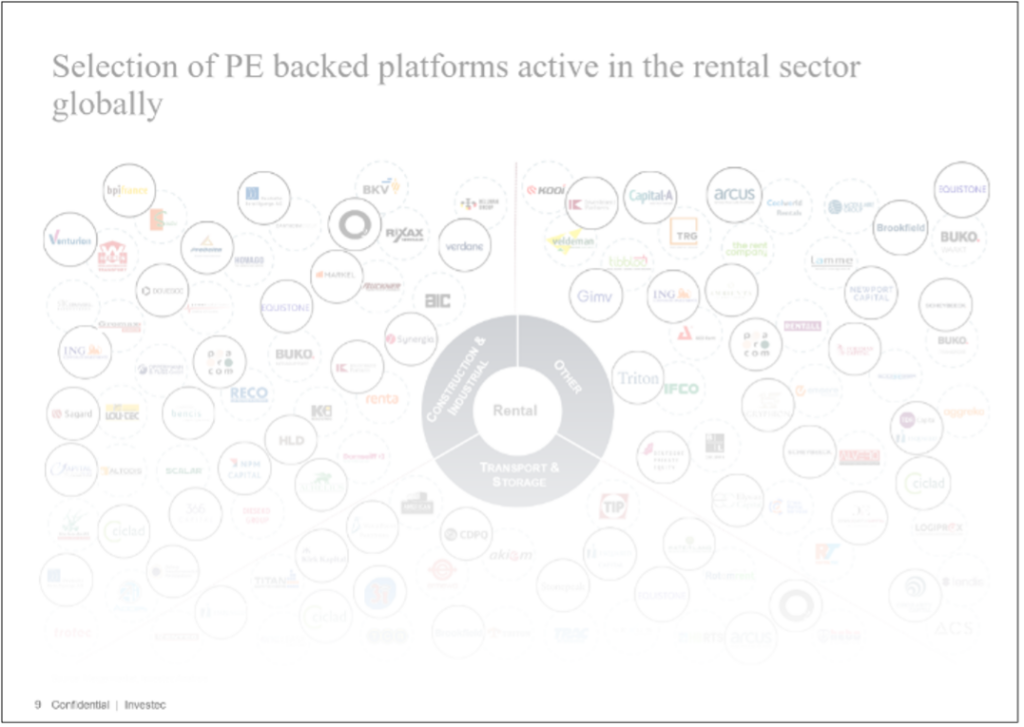

Increased interest of financial buyers

Rental businesses’ robust financial fundamentals, high asset utilisation, and repeat customer models have not gone unnoticed. The share of transactions executed by financial buyers rose from 21% in 2023 to 32% in 2024, highlighting their increased interest in the market.

In the Benelux, investors such as Parcom, 365 Capital, ING Corporate Investments, IK Partners, Capital A, Down2Earth Capital, GIMV, and more have (recently) acquired assets in the rental sector.

Investec has advised on numerous rental transactions, including the sale of:

- Coolworld Rentals – a specialist in sustainable HVAC solutions, to GIMV

- Stravers Torenkranen – a leading European supplier of electric tower crane solutions, sold to ING Corporate Investments

- Tibbloc – the French leader in temporary energy systems, backed by Cilclad, also to GIMV

Looking ahead

A growing preference for flexibility and reduced capital intensity is driving more businesses to integrate rental into their operating models. This shift also supports sustainability goals by promoting reuse, reducing waste, and extending asset lifecycles, which is becoming increasingly important to businesses and regulators.

M&A activity is set to keep growing, especially in certain niches and fragmented geographies. Both strategic and financial investors remain interested in the broad diversity of rental applications, platforms and recurring revenue streams.

At Investec, we believe the rental sector offers an exceptional blend of resilience, innovation, and long-term opportunity, making it one of the most compelling spaces in the European mid-market.

For more information and our full 2025 Rental Report, please contact Marleen Vermeer or Thom Deckers.