Client Stories

LBO of Siléane backed by Motion Equity Partners

Investec has advised Siléane shareholders on its LBO backed by Motion Equity Partners

About the deal

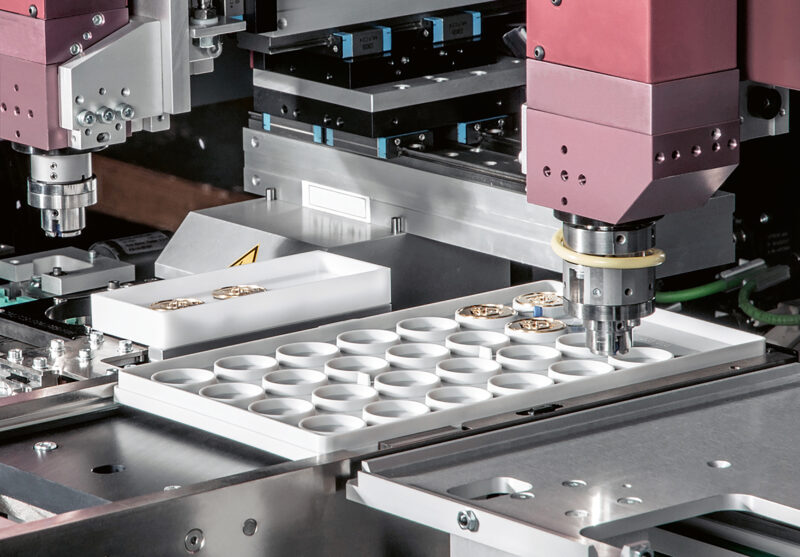

Founded in 2002 by Hervé Henry and based in Saint-Étienne (France), Siléane is the leading French provider of intelligent robotic solutions for industrial applications. Strategically positioned on resilient and fast-growing sectors (pharma, food, cosmetics, luxury, logistics, waste management, energy, nuclear, etc.), Siléane’s solutions automate tasks in random and unpredictable environments. Its technologies serve niche applications such as specialised processes and packaging, assembly and inspection, and nuclear decommissioning. With a strategy focused on innovation, Siléane relies on its distinctive proprietary technological expertise (vision, software, AI) and continuously invests in R&D, allocating around 10% of its revenue to R&D each year.

The Group has experienced strong growth, increasing its revenues from €10 million to over €35 million in 2024. It has strengthened its footprint in France through the successful opening of three sites in Toulouse, Rennes and Rouen, as well as the integration of four strategic acquisitions since 2020. These acquisitions have enabled the Group to enter new markets, to expand and enhance its technical know-how, and to reinforce its geographical footprint in France, in order to address key industrial hubs locally.

Two years after Siparex, Garibaldi, and EIC became minority shareholders, Motion Equity Partners acquire a majority stake in Siléane. With the support of its new shareholder, the group aims to accelerate its external growth strategy to expand its geographical footprint, both in France and internationally, to integrate complementary expertise, and to strengthen its teams with new talents and know-how.

Our role

Investec Advisory acted as exclusive advisor to the shareholders throughout the sale process, including:

- Defining the transaction strategy,

- Identifying potential acquirers,

- Preparing marketing materials,

- Coordinating due diligence reports,

- Coaching the management team,

- Managing the sale process,

- Negotiating the terms of the transaction.