Client Stories

LBO of Mastergrid backed by Ardian

Investec Advisory has advised Ardian Expansion on its acquisition of a majority stake in MasterGrid alongside the Management team

About the deal

Headquartered in Grenoble, MasterGrid is a leading provider of maintenance services and manufacturer of equipment for critical electrical infrastructure, with a particular focus on the high-voltage segment. Historically a business unit of Siemens, MasterGrid was carved out by Siemens to Andera Partners in 2019. Since then, the Group, which was focused on the manufacturing and maintenance of Merlin Gerin installed base of equipment, has successfully diversified its offering and expanded into 11 new countries both through organic and external growths (7 acquisitions realized since 2020).

MasterGrid’s operations are structured around three core business lines:

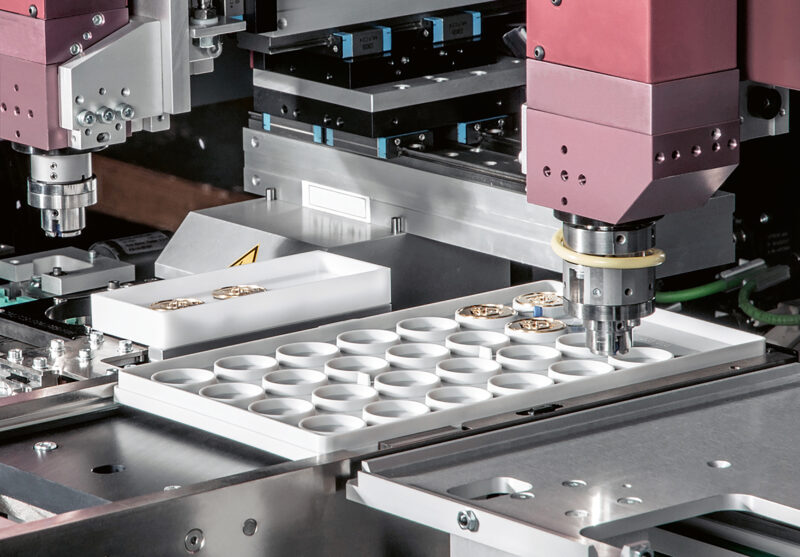

- Proprietary services and equipment, including the manufacturing of bespoke components, supply of spare parts, and comprehensive maintenance programs;

- Services on third-party equipment, allowing the company to serve a wide range of clients;

- Engineering & solutions, which provides tailored project design, technical innovation, and consulting to meet evolving customer needs.

The company is uniquely positioned to benefit from strong structural megatrends shaping the energy sector, such as the global energy transition, grid modernization, and the increasing integration of renewable energy sources. These trends are fueling unprecedented pan-European investments aimed at upgrading aging infrastructure, enhancing grid resilience, and expanding capacity to meet future demand.

With a broad geographic footprint spanning France, Europe, Africa, the Americas, and the Middle East, MasterGrid leverages long-term contracts and deep, trusted relationships with blue-chip operators worldwide. This solid foundation enables recurring revenue streams and positions the company for sustainable growth.

Nearly six years after its spin-off from Siemens, MasterGrid has chosen Ardian Expansion as its new majority financial partner to support the next phase of its ambitious growth strategy. With its unique technical expertise and long-standing client relationships, the company plans to capitalise on the expected massive investments in the electricity infrastructures, pursue the diversification in new equipment, and further accelerate its international expansion, particularly in Europe and the Middle East.

Our role

Investec Advisory supported Ardian Expansion throughout the entire acquisition process to assist in:

- Preparing investment committee materials,

- Identifying and assessing potential build-up targets,

- Providing valuation analyses,

- Drafting exit strategy considerations,

- Supporting the structuring of the management package,

- Offering deal strategy and negotiation support.