Client Stories

Refinancing for resilience: Stabilus locks in €150M Term-Loan & amends existing SFA

Investec has advised Stabilus on the successful closing of new €150m TLB and amendment of financial covenant in existing SFA.

About the deal

Stabilus SE has successfully closed a new € 150m term loan accompanied by an amendment of the existing SFA. The deal was backed by a majority of the existing consortium (6 banks). Signing and intra-day closing took place on 31 July 25.

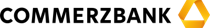

Founded in 1934 and headquartered in Koblenz, Stabilus SE (Stabilus) is a listed Company in the SDAX of the Frankfurt Stock Exchange. Stabilus is one of the world’s leading suppliers of motion control solutions for customers in a wide range of industries, including mobility, health, leisure, furniture, energy, construction, industrial machinery and automation. The Group offers a wide range of motion control solutions, such as gas springs, electromechanical drives, dampers, pneumatic and electronic grippers, clamps and end-of-arm tools for robotics, as well as indexers and conveyors.

In light of upcoming promissory note maturities in March 2026, the Company was seeking to increase its financial flexibility through raising a new €150m syndicated facilities and an amendment of its existing syndicated loan. The proceeds of the new loan will be used to repay the promissory notes.

Investec acted as Stabilus financial advisor, overseeing all commercial aspects of the refinancing, working in close collaboration with the senior management.

What we did

Investec’s Debt and Capital Structure Advisory team supported the deal end-to-end, in close collaboration with senior management at each stage of the process. Key tasks included:

- Benchmarking and assessment of indicative offers,

- CFO briefings and negotiation prep ahead of discussions with lenders and legal counsels,

- Support on negotiations of commercial terms in documentation process of the new syndicated facilities and the amendment of the existing SFA,

- Throughout the process, Investec provided negotiation support up to successful transaction closing.